AI applications remain the hottest space in 2025!

I paused my writing while traveling overseas during the Chinese Lunar New Year holiday.

However, my feed was flooded with discussions about DeepSeek reminded me of the early days when ChatGPT was first released.

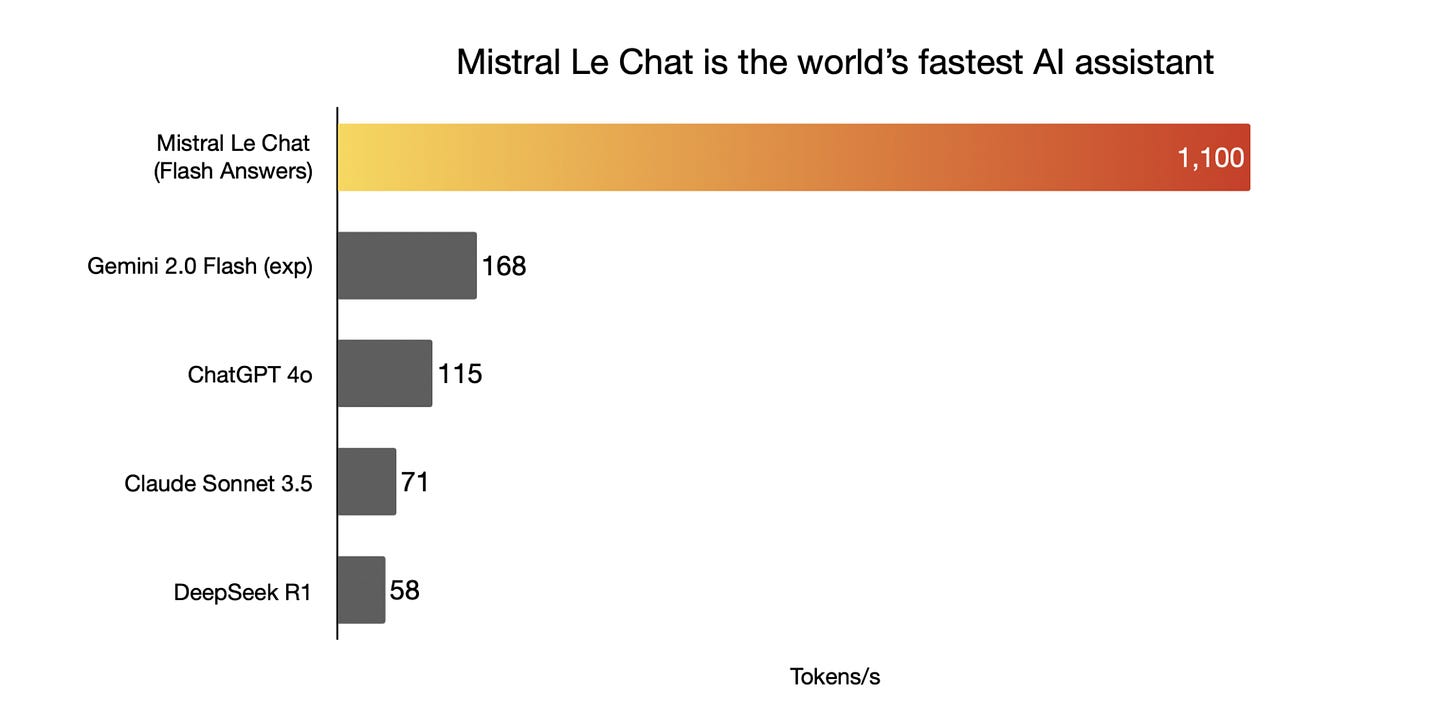

Days before, Mistral AI, a French large language model (LLM) company barely a year old, launched its latest AI assistant, Le Chat, which claims to be the fastest AI globally.

It processes tokens at a speed of 1,100 per second—nearly ten times faster than ChatGPT. I tested it, and its responsiveness, even for real-time internet searches, is indeed remarkable.

It is reported that Mistral AI’s latest model was trained at only one-fifth of OpenAI’s cost. Like DeepSeek, it is also open-source. It’s astonishing to see open-source LLMs emerging as a dominant force in AI development at the start of 2025.

For proprietary LLM providers, this shift presents substantial challenges—both financially and in terms of valuation. 2025 will be critical for those struggling to secure continued funding. With the rapid progress of open-source models, I strongly believe that LLMs might not be a good business on their own in the long run.

However, this shift greatly benefits AI applications. The market has already responded accordingly.

I highlighted several AI applications experiencing explosive revenue growth before, such as:

Post-holiday, the AI application boom shows no signs of slowing down. For instance, the AI coding tool Bolt.new reached $20M ARR in just 2 months, and then secured over $100M in funding.

Meanwhile, a similar product, Lovable, hit $10M ARR within the same timeframe.

Lovable ARR at $10M in 2 months

Lovable.dev is an innovative AI-powered platform that enables users to build high-quality software without writing code. It offers seamless integration with tools like GitHub and Supabase, making it easy to create and deploy applications.

The platform is also recognized for its ability to facilitate rapid app development, allowing users to create fully functional applications in a fraction of the time compared to traditional coding methods. For instance, users can build and deploy applications with features like authentication and data storage, achieving results up to 20 times faster than conventional coding practices.

After achieving $1M ARR in just 8 days and $4M ARR in 4 weeks, Lovable has now reached $10M ARR in 2 months after launching.

Anton Osika, CEO of Lovable, explained that most LLMs struggle with complex projects. Their approach involves semi-automating the identification and resolution of common LLM errors in web application development. This means that LLM knowledge is not the sole determinant of product quality, making Lovable unique. Their scalable AI system performs almost equally well on large and small codebases.

This surge in revenue has also attracted new entrants. Xiaoyin Qu, founder of Heeyo AI, recently launched HeyBoss, a similar AI-driven engineering tool designed for non-programmers.

Qu describes it as the world's first AI engineer that makes coding as intuitive as designing in Canva or creating content on TikTok. HeyBoss handles everything from design, front-end, back-end, deployment, integration, and APIs—without requiring a single line of code.

Competition in the space is heating up, prompting Replit to launch a free Replit Agent, enabling users to build software projects via natural language commands directly from their mobile app.

Meanwhile, many other AI applications hit a new ARR milestones:

Harvey AI ARR at $50M

Harvey AI is a generative AI platform specifically designed for professionals in the legal, tax, and finance sectors.

They achieved big milestones in 2024: 235 customers in 42 countries, 4x ARR, a growth from 40 to 228 employees, and a $100M Series C raise.

Now its ARR is reportedly at $50M, raising a round of $300M valuation at $3B.

Clay ARR at $30M

Clay.com is a powerful marketing and sales tool designed to enhance data enrichment, automate personalized outreach, and streamline the process of reaching potential customers. It integrates various data sources and employs AI to assist users in their outreach efforts, making it a valuable asset for businesses looking to scale their operations.

They 10x’d revenue in both 2022 and 2023, and 6x’d revenue in 2024. Their ~100-person team serves over 5,000 customers, including category leaders like OpenAI, Canva, Anthropic, Ramp, and Rippling.

After its Series B funding of $46 million raised in June 2024, which had valued the company at $500 million, it raised $40 million in a Series B expansion round, which brings its valuation to an impressive $1.25 billion. And its ARR is nearing $30M.

What is more, three other AI applications recently announced that their ARR has surpassed $100 million. The pandemic-accelerated global payroll and HR platform Deel ended 2024 with an ARR exceeding $800 million, marking a 70% year-over-year growth in just 5 years.

Deel ARR 𝗵𝗶𝘁𝘀 $𝟴𝟬𝟬𝗠 𝗶𝗻 𝗷𝘂𝘀𝘁 𝟱 𝘆𝗲𝗮𝗿𝘀

Deel is a global payroll and human resources platform designed to simplify the management of international workforces.

It offers a comprehensive suite of services that includes: Global Payroll: Deel allows companies to pay employees and contractors in over 150 currencies, ensuring compliance with local laws and regulations. Hiring Solutions: The platform provides tools for hiring remote talent globally, including contract management and onboarding processes. Compliance Management: Deel helps businesses navigate the complexities of international labor laws, ensuring that they remain compliant with local regulations.

As of December 2024, Deel achieved a run rate of $800 million, reflecting a 70% year-over-year growth, and has been profitable for over two years.

Deel’s rapid ascent makes it one of the fastest-growing companies in history, now serving over 35,000 clients, including Shopify, Reddit, Nike, Hermes, and Red Bull. The company was initially founded to create fairer opportunities for global talent, recognizing that Silicon Valley engineers earned ten times more than their counterparts in their home countries.

In 2019, Deel joined Y Combinator (YC) and quickly identified inefficiencies in contracts, payroll, and HR, particularly after discussions with other YC founders. Then came 2020—remote work became a necessity, fueling Deel’s explosive growth and attracting top-tier VCs.

Within five years, Deel has reached its Series D+ round, recently facilitating a secondary sale where General Catalyst and Mubadala acquired $300 million in shares at a $12.6 billion valuation from early investors.

YC originally invested $150,000 in Deel in 2019 at a $2.1 million valuation. In just five years, that investment has yielded a staggering 5,000x return, reaffirming the allure of venture capital.

3 AI Applications hits $100M ARR

The three AI applications that recently crossed the $100M ARR milestone have achieved extraordinary growth, the fastest in just 21 months: