a16z’s $25B LP Return, Sequoia's one fund give extra $6.7B LP return in 3.5 years

And 4 minimalist yet profitable products

In Sequoia’s 50-year history, its fingerprints are everywhere—Apple, Cisco, Nvidia, Google, Palo Alto Networks, ServiceNow, and the list goes on.

Together, these companies represent nearly one-third of Nasdaq’s total market cap.

But Sequoia’s managing partner Roelof Botha says their biggest insight came not from what they built — but from what they kept, in a recent interview on All-In Podcast.

Great companies keep compounding, even after the IPO.

🧠 Sequoia’s Patience Engine gives LP extra $6.7 billion in only 3.5 years

In 2022, Sequoia launched the Sequoia Capital Fund — a permanent structure that allows them to hold public stocks long after IPOs.

Instead of distributing shares to LPs within 6 or 12 months, Sequoia transfers them into this evergreen fund, which then reinvests the profits into new ventures.

The result?

In just 3.5 years, this “do nothing, just keep holding” strategy added $6.7 billion in net gains for their LPs.

Roelof puts it simply:

“When we distributed shares too early, LPs didn’t know the company and often sold immediately. Patience is the real alpha.”

He loves quoting Jack Dorsey:

“A company has multiple founding moments.”

Square’s story proves it — half its current revenue comes from Cash App, a product that didn’t exist in the company’s first five years.

Great founders reinvent themselves.

And Sequoia’s bet is to stand by them, even after the ticker symbol appears on Wall Street.

💼 a16z: The Evolution of Venture

If Sequoia’s story is about patience, a16z’s is about scale — and how scale changes everything.

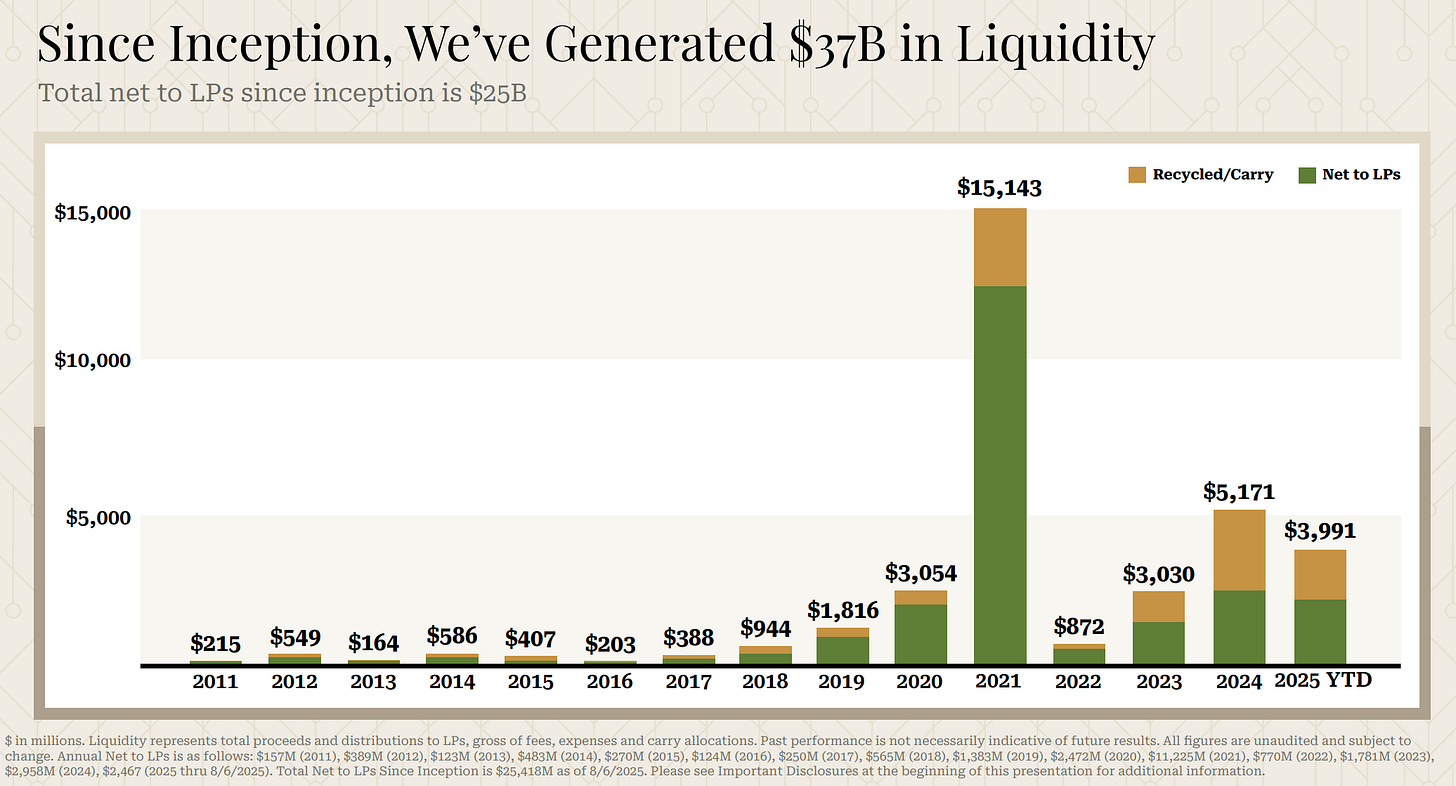

Since its founding in 2009, Andreessen Horowitz (a16z) has returned over $25 billion to LPs — with $11.2 billion of that coming from 2021 alone.

That year marked the SaaS peak — and a16z became its biggest winner.

Its standout exits include:

Coinbase: Early B-round lead in 2013, exiting $4.5B+ at IPO

Robinhood: Seed investor since 2013

Roblox: $1.5B Series G lead in 2020

Marqeta: Multiple rounds, IPO valuation $15B

Stack Overflow: Acquired by Prosus for $1.8B

Affirm: IPO at $11.7B valuation

The math is staggering.

Even with standard 2/20 VC economics, a16z’s management fees alone are ~$700M per year — but insiders say their terms are actually 3% and 30%, meaning real fees are far higher.

🧩 Consensus Capital: The New VC Archetype

As former TechCrunch editor Erick Schonfeld put it, a16z is no longer a “venture firm” in the traditional sense.

It’s an RIA — a registered investment advisor — operating more like a hybrid of asset manager, incubator, and media company.

VC Leslie Feinzaig calls this new model Consensus Capital — massive funds chasing massive outcomes.

Their logic:

Forget unicorns. They’re hunting trillion-dollar outcomes.

Founders fit a certain “consensus” archetype — elite schools, elite labs, elite networks.

Price sensitivity? None.

Capital per round? Tens or hundreds of millions.

As a result, early-stage investing has shifted from contrarian bets to pre-consensus validation.

Even AI application startups like Cursor are now valued at $20B, with early investors already taking partial exits in secondary markets.

“It’s no longer about finding non-consensus truths,” Feinzaig writes.

“It’s about predicting which non-consensus truths will become consensus.”

Lessons from the Builders of Simplicity: 4 minimalist yet profitable products

While capital pools at the top, a quiet rebellion is happening below — led by indie developers building radically simple, highly profitable tools.

They don’t raise money. They don’t chase hype.

They just pick a problem, solve it completely, and charge for it.

Here are four such products — each a case study in precision and restraint.