Replit ARR near $150M, The AI Native ERP 2x ARR in 12 weeks

a16z and Sequoia Battle Over AI Hardware Startup

Some big milestones last week from my ARR tracker:

Armis ARR Hits $300 M

Armis is a leading cybersecurity platform specializing in exposure management across connected environments. Its flagship product offers comprehensive asset visibility and risk management across IT, medical devices, OT, cloud, software and code.

By proactively identifying and securing critical infrastructure, its AI-powered platform enables global organizations to transition from reactive “detect and respond” strategies to proactive exposure risk mitigation. Clients include major multinationals like United Airlines, Colgate‑Palmolive, and Mondelez, reflecting strong enterprise adoption across industries.

With anticipated expansion into air‑gapped and hybrid deployments, new product launches, and deepened partnerships with AWS, Accenture, PwC, Fortinet, and Google, Armis is widely expected to pursue an IPO in 2026 with projected revenue reaching around $500 million.

As surpassed $300 million in annual recurring revenue (ARR) as of early August 2025, marking an impressive $100 million increase in under a year—growing from around $200 million in ARR less than 12 months ago.

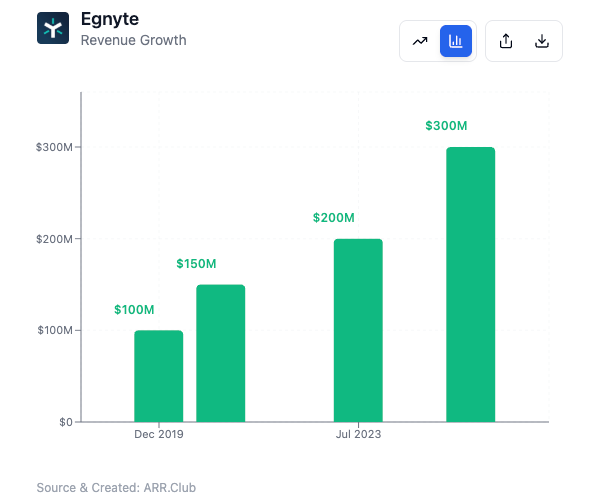

Egnyte ARR Hits $300M

Egnyte is a hybrid cloud content platform that scales enterprise file sharing, data governance, and collaboration for customers across SMB and large enterprise segments.

Its product suite solves the complex problem of secure, scalable content access and governance across distributed teams and hybrid infrastructures.

The platform’s value proposition is its ability to adapt workflows and entitlements across wildly different deal sizes and procurement processes: lightweight onboarding and frictionless self-service for SMBs, while offering robust controls, CPQ-driven quoting, and compliance features required by enterprise and government customers.

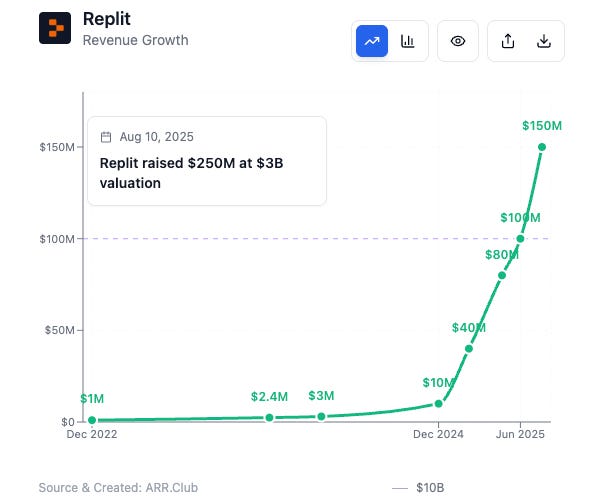

Replit ARR is nearing $150M($144M)

The AI coding space is becoming a full-on arms race. Just two weeks ago, Lovable announced a $200M raise at a $1.8B valuation with ARR surpassing $100M. Now, Replit has closed another major round.

According to Forbes, Replit raised $250M in a round led by Prysm Capital, valuing the company at $3B — more than double its previous $1.16B valuation.

The company hasn’t formally announced the round yet. Y Combinator founder Paul Graham revealed that Replit’s ARR had already reached $144M(nearing $150M) in July, confirmed by CEO Amjad Masad.

Just over a month ago, Replit had only just broken the $100M ARR mark. The growth is crazy impressive.

Paul Graham points out that Replit isn’t just a code generator — it has spent years building full deployment infrastructure, a key differentiator from other AI coding tools.

Some Replit’s Product Updates are important

Recently, Replit launched a series of new features, particularly after addressing a significant security incident. Last week, it rolled out “Checkpoints & Rollbacks.” Checkpoints automatically capture your project’s full state — not just code changes, but workspace content, AI conversation context, and even connected database data. Rollbacks let you restore your application to any previous state with a single click.

Another feature I like is the separation of production and database environments. Agents can now operate in a dedicated development database without touching production until deployment. While a manual version of this existed before, it’s now automated — something most “Vibe Coding” platforms still lack. This separation reduces the risk of downtime and gives developers more freedom to experiment.

Replit also now lets users search for, purchase, and manage domains directly on-platform — continuing the trend toward all-in-one AI coding ecosystems.

Business Model Shift

Masad has acknowledged that Replit’s original flat-rate pricing was unsustainable, pushing margins into the red. They’ve since moved to usage-based billing, which has lifted gross margins to ~23% overall. The long-term vision is autonomy: soon, Agents will run for over an hour continuously, making usage-based pricing the only viable path.

Enterprise customers — who care about security, privacy, and advanced features — are now a key target. This segment offers margins of up to ~80%. Purely consumer-facing AI coding products with flat-rate pricing and limited scope may find profitability much harder to achieve.

The AI Native ERP doubled ARR in the past 12 weeks

Late last year, an AI “colleague” called Sapien had just pulled in nearly $9M in seed funding. It is an AI-native platform for finance & operations teams that understands your company. The target customers are for CFOs, FP&A, strategic finance, operations, and data teams.

Now, another AI for the finance space has landed fresh funding — and in less than a year, it’s closed two rounds totaling over $100M.