Hey, welcome so many new friends onboarding. Today’s trending signal is Invision, a sad story for people who relate to it.

The design platform is shutting down at the end of this year. Words from CEO Michael Shenkman:

Today I am writing to share that after careful consideration we have made the difficult decision to discontinue InVision’s design collaboration services (including prototypes, DSM, etc) at the end of 2024.

Some Facts:

Invision surpassed $100M ARR 3 years ago in 2018;

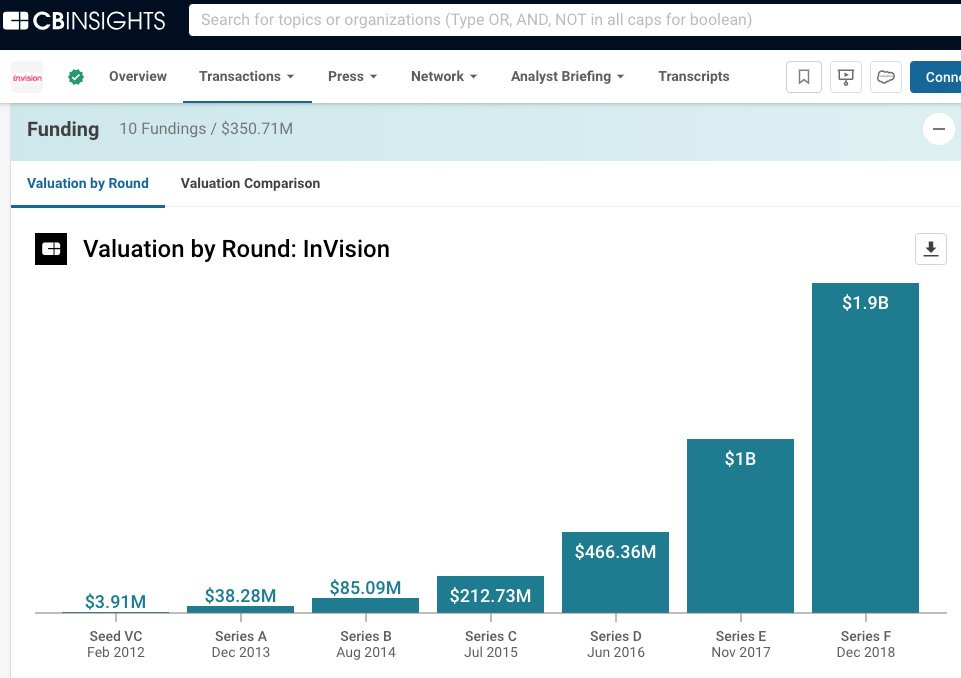

Last raised $115M in 2018, total Raised $350M, valuation at 1.9B, and reached unicorn status in 2017.

Sold its Freehand Business to Miro in Nov 2023.

Some data from CBInsights’ CEO Anand Sanwal:

Invision Fundraising and valuation journey:

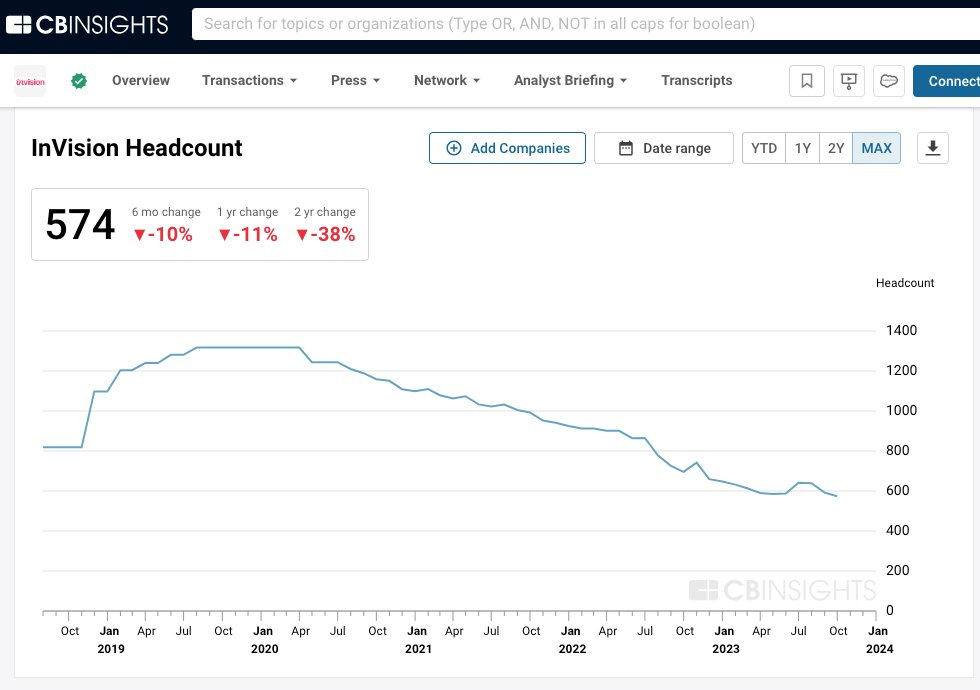

Contracting since 2020 revealed from its headcount data:

The competitors landscape:

Who kills Invision:

Figma or some other competitors? Maybe perspectives from Invison alum Jess Meher tell the story:

I worked at InVision during its heyday, from $15m-$100m in revenue. If nothing but to share an important takeaway for other founders, Figma is not why InVision failed.

Simply, InVision failed because they stopped listening to customers. Figma built tools InVision customers had been asking for for years. InVision had become so obsessed with winning against Adobe and Sketch, and trying to own the end-to-end design system on a much too aggressive timeline that it lost sight of solving for the customer on what they needed at that moment in time, not years from now.

While InVision focused on Adobe, Figma focused on quietly building a better product, slowly. Figma had only raised $15m until 2018, and it took them 8 years to hit their first $1M in rev.

It’s really easy to point fingers at the innovator dilemma (totally a fair point), my POV (which may reflect differently from others whom I respect)…figma’s entrance just exposed an internal weakness at InVision, that at which point when you’re already a $100m business, is really hard to course correct.

Lessons learned:

Focus on your customers, not your competitors.

100M ARR CLub

1. Commercetools at $100M ARR

Commercetools is a cloud-based e-commerce platform that provides various tools and services for businesses to build and manage their online retail operations.

It experienced 80% topline growth in 2022 and added 130+ new enterprise-sized customers, 30+ in Q1 2023.

Raised $140 million in a Series C funding round, valuing the company at $1.9 billion.

10M ARR Club

2. Beefree at $10M ARR

Beefree provides intuitive design tools that empower businesses to create beautiful, high-performing emails that work with any marketing platform.

ARR surpassed 10M while at 7M in 2021. More than 1,600 templates.

MAU in millions from 150 countries. The design tools are embedded in 600+ SaaS applications.

1M ARR Club

3.Visually at $1M ARR

Visually is a next-generation optimization and personalization platform that uses data and AI to allow Shopify brands to control their site without code.

It surpassed $1M ARR in less than a year. Supported over 20k live experiences, and over $1B of revenue through them.

Ran thousands of a/b tests, and engaged with over 150m sessions of shoppers.

4. Newcomer at $1M ARR

Newcomer is a startup and venture capital-focused media and events business.

Generated over $1M in revenue last year and is profitable. It has 75,000 free subscribers and more than 2,000 paying subscribers.

Newcomer provides quality, exclusive stories about money, people, and technology in the startup and venture capital industry, delivered in a direct and authentic style.

5. Dub at a MRR of 13x growing

Dub.co is the open-source link management infrastructure for modern marketing teams.

13.8K Github stars, 250K links created, 16.5M clicks tracked, 1.7K domains added in 2023.

MRR Increased by 13x.