Replit ARR hit $250M, This Guy Built a $90M ARR Platform by Acquiring Indie SaaS

SaaS acquisitions can generate returns from day one

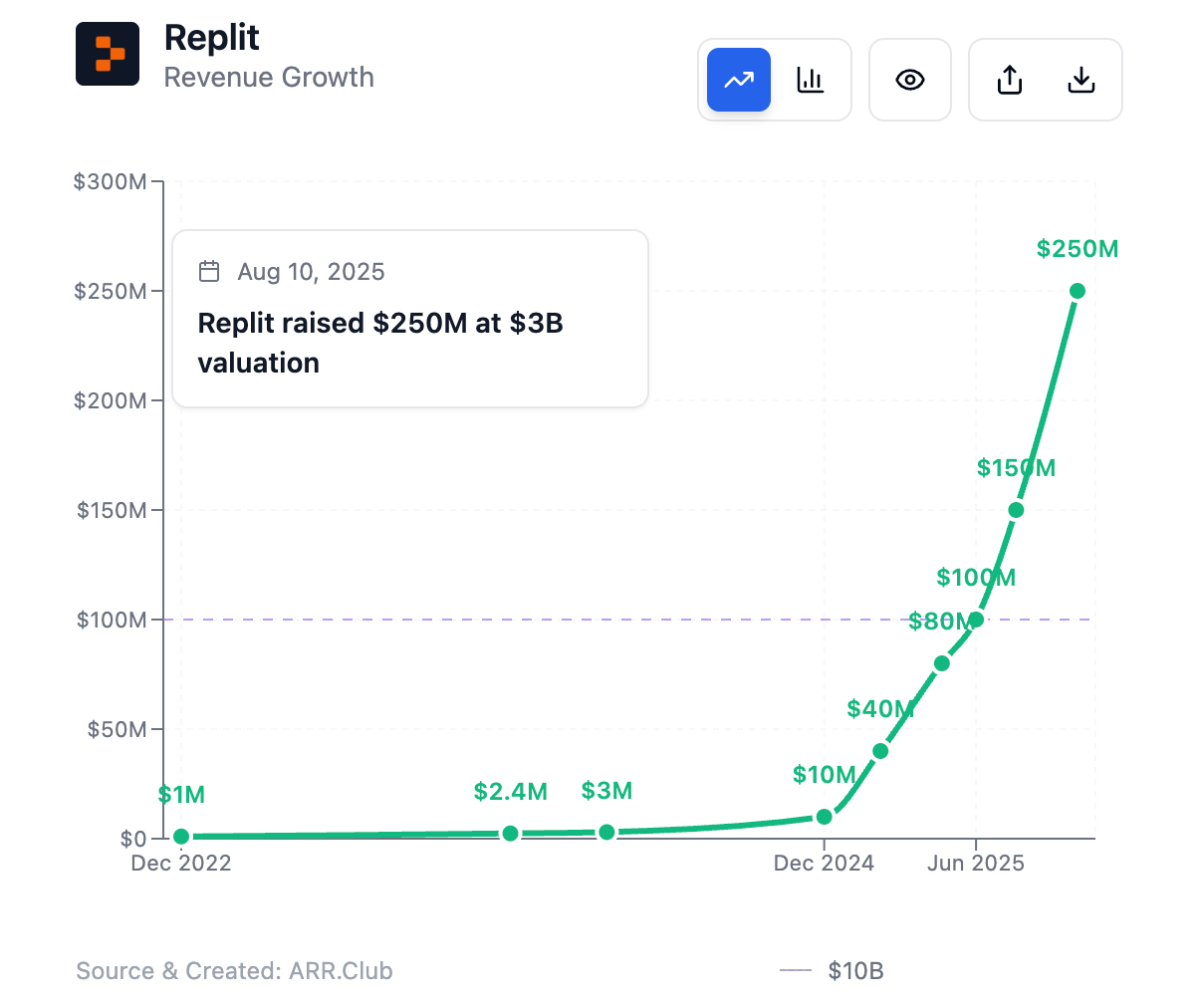

In the AI Coding space, Replit has become one of the fastest-growing companies ever.

It went from $10M to $100M ARR in just six months, and only two months later crossed $150M ARR.

Now, Replit’s ARR is reportedly approaching $250M, and CEO Amjad Masad said the company expects to surpass $1B ARR by the end of 2026, a full year earlier than previously planned.

According to Business Insider, as of June 2025, Replit has 40 million users, with over 150,000 paying customers. Over the past year, the average revenue per user has doubled.

Masad said that a large portion of Replit’s explosive revenue growth has come from enterprise customers such as Duolingo and Zillow, whose adoption of Replit has surged dramatically.

He noted that Replit has partly replaced internal no-code and low-code tools that many companies used to rely on — tools that initially boosted productivity but eventually slowed teams down.

On the profitability side, Replit’s enterprise accounts deliver margins as high as 80%, since enterprise seats can cost up to $100 per user, often with usage-based pricing layered on top.

The Pain Before the Breakthrough

But the early years were rough.

Masad shared that it took eight years since its founding in 2016 for Replit to find product–market fit. They tried multiple business models — even charging schools — but growth stagnated.

By 2021, ARR had reached $2.83M, but revenue plateaued for years afterward. At its peak, the company had 130 employees, far more than revenue could sustain, forcing them to lay off half the staff.

Then came the turning point:

In fall 2024, they launched Replit Agent, which Masad called “the world’s first agent-based coding experience — not just writing code, but debugging, deploying, configuring databases, acting as a true software partner.”

In January 2025, Replit officially announced it would move away from targeting professional developers and instead focus on turning non-technical knowledge workers into a billion new software creators.

He described this as an entirely new market, believes Replit’s key advantage lies in serving non-technical users and the infrastructure it has built around deployment and database management — something foundational model companies still tend to overlook.

Vibe Coding: Traffic & Momentum

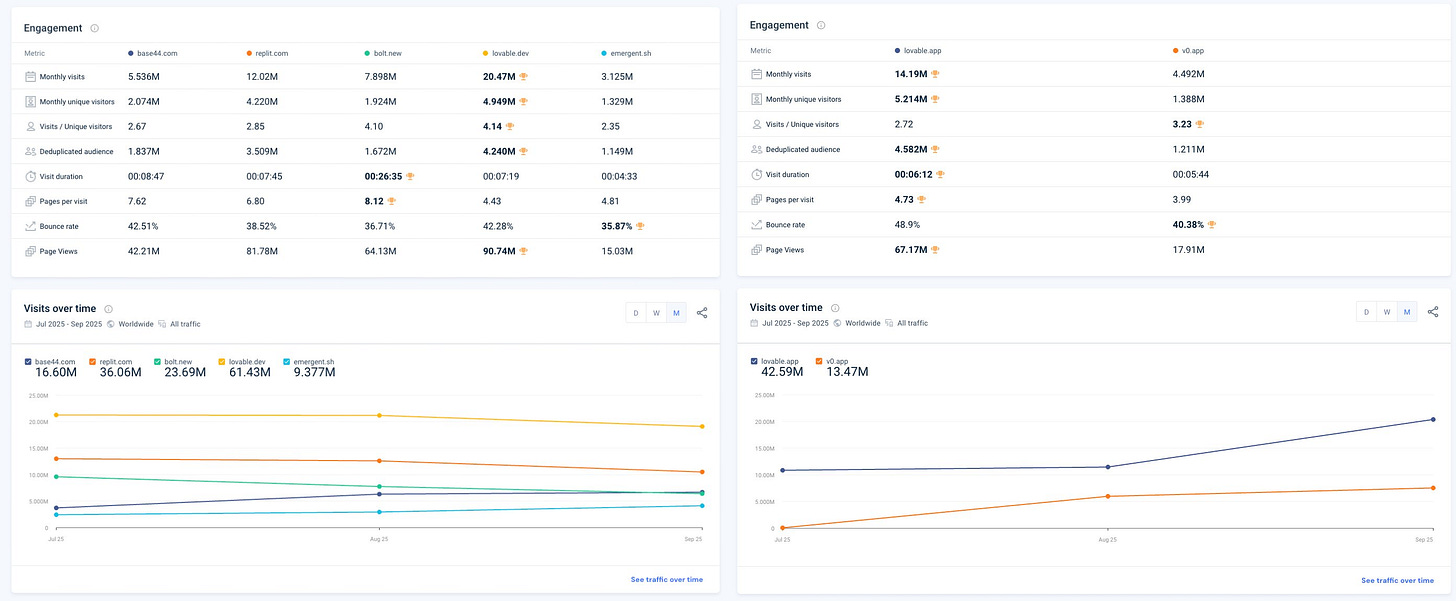

According to SimilarWeb, based on web traffic alone, the Vibe Coding landscape looks like this:

Lovable — 34M visits

Replit — 12M

Bolt — 8M

Base44 — 5.5M

V0 — 4.5M

Emergent — 3M

Among them, Emergent is rising fastest — it just raised $23M Series A and reached $15M ARR within three months of launch.

Building a $90M ARR Platform by Acquiring bootstrapped SaaS

When most of the capital market focuses on hypergrowth startups with massive stories, one of my favorite venture studios has quietly taken the opposite path — targeting independent, bootstrapped SaaS products built by small teams that are profitable but growing slowly.

Through systematic acquisitions, it has built a SaaS platform now exceeding $90M ARR.